.

"It was a splendid population - for all the slow, sleepy, sluggish-brained sloths stayed at home - you never find that sort of people among pioneers - you cannot build pioneers out of that sort of material. It was that population that gave to California a name for getting up astounding enterprises and rushing them through with a magnificent dash and daring and a recklessness of cost or consequences, which she bears unto this day - and when she projects a new surprise the grave world smiles as usual and says, "Well, that is California all over."

- - - - Mark Twain (Roughing It)

Saturday, December 3, 2022

Monday, June 27, 2022

Voters Bribed by Democrats Before Election Day

(CBS News) About 23 million California residents will soon receive "inflation relief" checks of up to $1,050 under a budget deal reached by Governor Gavin Newsom and state lawmakers on Sunday.

The checks are part of a $17 billion relief package that will also suspend the state's sales tax on diesel fuel and provide additional aid to help people with rent and utility bills, Newsom and Senate President Pro Tempore Toni G. Atkins and Assembly Speaker Anthony Rendon said in a statement.

The agreement comes as California drivers face the highest gasoline prices in the U.S., with the average price for a gallon of gas in the state at $6.32 on Monday — or about 29% higher than the national average.

Earlier this year, Newsom had proposed sending stimulus checks of $400 per vehicle to state residents, with a cap of two vehicles. But other lawmakers had pushed for a plan that would provide bigger checks to people who earn less.

Friday, January 21, 2022

Somali Pirates vs California

California Becomes a Marxist Shithole

In other words, nothing is changing

Follow The Black Pigeon Speaks on the free speech video platform Bitchute.com

Saturday, October 3, 2020

California Losing so Many People It Wants to Tax Those Who Leave

That Sinking Feeling

Must See Video

- Marxist Democrats Drive People Out of California

Subscribe to Styx on the free speech video platform Bitchute.com

San Francisco Rents Crash Most On Record Amid Mass Exodus

(Zerohedge) - A new report confirms what we've been talking about since the early days (read: here) of the virus pandemic, that is, an exodus out of major cities.

According to real estate analytics company Zumper, the exodus, out of San Francisco has been so great, that the median rent for a one-bedroom apartment collapsed more than 20% in September from a year ago to $2,830. Month over month, September rent for a one-bedroom apartment in the city fell by 7%.

Referring to the plunge in rent prices in San Francisco, Zumper said:

"Not only is this drop among the largest yearly decreases Zumper has ever recorded in our history of tracking rental prices, but it was also the first time the median 1-bed price in San Francisco was priced below $3000. These combined trends show just how drastically the market has changed in the nation's most expensive city to rent."

Zumper CEO Anthemos Georgiades, who was quoted by CNBC, said a flood of supply is hitting the market:

"Some renters may be inclined to move to the suburbs to get more space, as the Covid-19 pandemic spurred companies to close offices and allow employees to work from home. Facebook and Google, for example, have told employees they can work remotely at least through next summer," Georgiades said.

The virus-induced downturn, resulting in the collapse of small businesses citywide, the decimation of low-income households, and high-unemployment, is forcing many folks across the metro area to downsize or move to less expensive areas. He said wildfires and hazardous air conditions were some other reasons for "tipping the balance about their medium-term location choices."

Social unrest and the rise of violent crime have made many folks uncomfortable about raising a family in the dangerous metro area. Many are moving to rural communities of the Bay Area, from Marin County to Napa wine country and south to Monterey's Carmel Valley.

Georgiades said it could take years for San Francisco real estate to heal from its pandemic wounds

Wednesday, August 5, 2020

A 54% Marxist Tax Rate Proposed By Democrats

(CNBC) - A proposal to raise taxes on California millionaires would result in a top tax rate of nearly 54% for federal and state taxes.

Democrats in the California state legislature this week proposed a tax hike on the state’s highest earners to help pay for schools and services hurt by the coronavirus pandemic. Legislators say the tax hike would raise more than $6 billion a year, and would redirect funding from the wealthy to those who have been hit hardest by the Covid-19 crisis.

The plan follows proposals in New York state to raise taxes on the wealthy to pay for a widening budget deficit. And it adds to a growing debate over expanding inequality during the pandemic and who should pay the soaring costs to government.

Yet the California proposal would raise the highest state tax rate in the country even higher, and renew the possibility of wealthy Californians fleeing the state.

California’s top marginal tax rate is 13.3%. The new proposal would add three new surcharges on seven-figure earners. It would add a 1% surcharge to gross income of more than $1 million, 3% on income over $2 million and 3.5% on income above $5 million.

So the top tax rate would be 16.8%, on income of more than $5 million and the combined state and federal tax rate for California’s top earners would soar to 53.8%. With the deduction on state and local taxes capped at $10,000 under the Trump tax cuts, the top-earning Californians wouldn’t be able to deduct the new taxes from their federal returns.

CNBC.com

Monday, July 27, 2020

Joe Rogan moving from California to Texas for 'more freedom'

Wednesday, January 15, 2020

Leaving California

People are leaving the state of California in droves and it could leave a lasting mark on the world’s 5th largest economy.

Monday, April 1, 2019

California may be reaching the point of ‘taxuration’

By JON COUPAL

OCRegister.com

Wednesday, February 20, 2019

California Agencies "hoarding vast sums of money"

- Every other word out of a Democrat is he needs more tax money - - - - Meanwhile government agencies are hoarding tens of billions of dollars.

Wednesday, January 23, 2019

Democrats approve 25-cent fee on disposable cups

― Robert A. Heinlein, Stranger in a Strange Land

SAN FRANCISCO — Patrons of restaurants and coffee shops in Berkeley, California, who don't bring a reusable cup for their beverage will have to pay a 25-cent fee for a disposable cup as part of an ordinance approved by city officials to eliminate restaurant waste.

Sunday, January 13, 2019

Democrats to tax drinking water

California Governor Gavin Newsom proposed his first budget for the state on Friday, and it includes a tax on drinking water.

The budget, titled “California for All,” declares drinking water a “fundamental right,” and adds: “The Budget includes short-term measures to bring immediate relief to communities without safe drinking water and also proposes an ongoing sustainable funding source to address this problem into the future.”Safe and Affordable Drinking Water Fund—Establish a new special fund, with a dedicated funding source from new water, fertilizer, and dairy fees, to enable the State Water Resources Control Board to assist communities, particularly disadvantaged communities, in paying for the short-term and long-term costs of obtaining access to safe and affordable drinking water. This proposal is consistent with the policy framework of SB 623, introduced in the 2017-18 legislative session. The Budget also includes $4.9 million General Fund on a one-time basis for the State Water Resources Control Board and the Department of Food and Agriculture to take initial steps toward implementation of this new Safe and Affordable Drinking Water Program, including (1) implementation of fee collection systems, (2) adoption of an annual implementation plan, and (3) development of a map of high-risk aquifers used as drinking water sources.

Friday, December 28, 2018

Thursday, July 5, 2018

Democrats to tax family businesses to death

(Sacramento Bee) - Chuck Collins, a researcher for a progressive Washington, D.C., think tank, recently wrote a ringing endorsement of a proposed 2020 ballot measure that would impose a state-level estate tax to pay for free college for all Californians (“One way to offer free college: Restore the state estate tax,” Viewpoints, June 13).

Collins apparently doesn’t realize, or doesn’t care, that this $4 billion-a-year proposal would create financial hardships for family businesses and farms that often result in liquidation and loss of jobs.

Family businesses are the bedrock of their communities and the economy. A recent study showed that the state’s 1.4 million small businesses employ 7 million people. They tend to pay their employees more, train them better and provide more generous benefits than non-family companies. They’re also less likely to significantly downsize during tough economic times.

Because families are in it for the long term, they focus not just on the next fiscal quarter but the next quarter-century. And because they’re based in their communities, they donate time and money for local organizations and projects.

But keeping businesses family-owned is a struggle. Only about 30 percent survive into the second generation, about 12 percent into the third generation and just 3 percent operate in the fourth generation and beyond.

To help family businesses pass from one generation to the next, four states have repealed their estate taxes since 2010. Fortunately, two initiatives passed by voters in 1982 prohibit an estate tax in California, and that can only be changed by the voters.

The Family Business Association of California vigorously opposes a “death tax” for California and leads a coalition of 40 associations against the flawed concept. To quote Nobel Prize-winning economist Milton Friedman in a letter that’s been signed by more than 700 other economists: “It is a bad message and a bad tax. Death shouldn’t be a taxable event.”

Robert Rivinius is executive director of the Family Business Association of California. He can be contacted at Robert@mybfa.org.

Read More . . . .

Tuesday, December 12, 2017

Sex Helps California Democrats to lose Assembly supermajority

Sunday, November 12, 2017

Wednesday, November 1, 2017

Democrats jack up gas taxes

"It's expensive, but I can afford it at the moment," Alvarez said. "I'm able to survive. Anything more than that, you're pushing the limit."

The money from the increase will add up to $52 billion over the next decade to fund transportation projects.

On the same day the gas tax increase will take effect, gas stations will switch from the summer gas blend to a cheaper winter blend which AAA said should minimize the impact of the tax hike.

Since the increase was opposed by the California Republican Party, some residents like Alvarez might change the way they vote.

"I do care about the roads, but I also have to care about regular people like myself, how it affects our bank account." Alvarez said.

Along with the 12-cent increase for regular and premium gas, diesel consumers can expect a 16-cent increase on a gallon of gasoline.

Read More . . . .

Tuesday, September 26, 2017

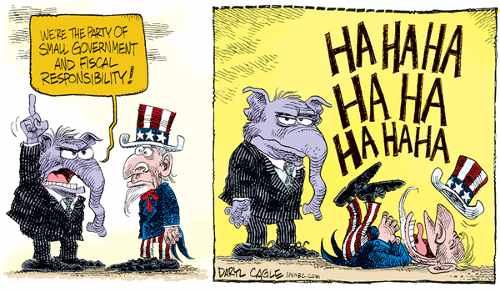

Will taxpayers trust the GOP again?

- The fools running the GOP refused to even put a proposition on the ballot to repeal the insane money-pit bullet train.

- If you don't actually believe in anything then how can you oppose Marxism?

By Jon Coupal;

Read More . . . .